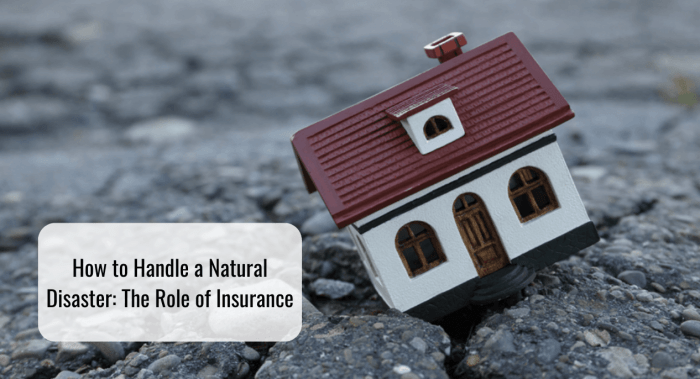

Delving into the realm of Homeowners Insurance Quote Planning for Natural Disaster Risks, this guide offers valuable insights in a manner that is both engaging and informative.

Exploring the various aspects of homeowners insurance in relation to natural disaster risks, this guide aims to equip readers with essential knowledge for effective planning.

Importance of Homeowners Insurance Quote Planning for Natural Disaster Risks

Planning for natural disaster risks when obtaining a homeowners insurance quote is crucial to ensure that your home and belongings are adequately protected in the event of an unforeseen catastrophe. Without considering these risks, you could face devastating financial losses that may be difficult to recover from.

Potential Consequences of Not Considering Natural Disaster Risks

- Without proper planning for natural disaster risks, you may find yourself underinsured and unable to cover the costs of repairing or rebuilding your home after a catastrophic event.

- Not considering these risks could lead to significant out-of-pocket expenses to replace damaged or destroyed belongings, as standard homeowners insurance may not cover all losses related to natural disasters.

- In the absence of adequate coverage for natural disasters, you may also face challenges in finding temporary housing or alternative accommodations while your home is being repaired or rebuilt.

How Homeowners Insurance Can Help Mitigate Financial Losses

- Homeowners insurance typically provides coverage for damages caused by natural disasters such as hurricanes, wildfires, earthquakes, and floods, helping to offset the costs of repairs or replacements.

- Additional coverage options, such as flood insurance or earthquake insurance, can be added to your policy to ensure comprehensive protection against specific natural disaster risks that are not covered under a standard policy.

- In the event of a covered loss, homeowners insurance can help ease the financial burden by providing compensation for damaged property, temporary living expenses, and liability protection in case of injuries or property damage to others on your premises.

Factors to Consider when Planning for Natural Disaster Risks

When evaluating insurance needs for natural disasters, homeowners must consider various factors that can impact their coverage requirements.

Impact of Location on Coverage Needs

The location of a home plays a crucial role in determining the type of coverage needed for different natural disasters. For example, homes located in coastal areas are more prone to hurricanes and flooding, so homeowners in these regions may require additional coverage for wind and water damage.

On the other hand, homes in earthquake-prone areas will need specific coverage for earthquake damage. Understanding the natural disaster risks associated with the location of a home is essential for determining the appropriate insurance coverage.

Influence of Age and Condition of Home

The age and condition of a home can significantly influence insurance planning for natural disaster risks. Older homes may be more vulnerable to damage from natural disasters due to wear and tear, outdated construction materials, or inadequate structural reinforcements. In contrast, newer homes built with modern construction techniques and materials may be more resilient to natural disasters.

Homeowners should consider the age and condition of their home when evaluating their insurance needs to ensure adequate coverage in the event of a natural disaster.

Types of Natural Disasters Covered by Homeowners Insurance

In most homeowners insurance policies, certain types of natural disasters are covered to provide financial protection to homeowners in case of property damage or loss. It's important to understand the coverage for different types of natural disasters and consider additional riders or policies for comprehensive protection.

Common Natural Disasters Covered

- 1. Hurricanes: Homeowners insurance typically covers damage caused by hurricanes, including wind and rain damage.

- 2. Earthquakes: Standard homeowners insurance policies usually do not cover earthquake damage, so homeowners may need to purchase a separate earthquake insurance policy.

- 3. Floods: Flood damage is usually not covered by standard homeowners insurance, so homeowners may need to buy a separate flood insurance policy through the National Flood Insurance Program (NFIP).

- 4. Wildfires: Coverage for wildfire damage may vary depending on the insurance provider and location of the property. Some homeowners may need to purchase additional coverage for wildfire protection.

Additional Riders or Policies

- 1. Earthquake Insurance: Homeowners in earthquake-prone areas may need to consider purchasing earthquake insurance as a separate policy to cover damages from earthquakes.

- 2. Flood Insurance: If a property is located in a flood-prone area, homeowners should consider purchasing flood insurance to protect against flood damage.

- 3. Wildfire Insurance: In areas at high risk of wildfires, homeowners may need to explore additional coverage options or wildfire insurance to ensure comprehensive protection.

Steps to Take in Preparing for Natural Disasters with Homeowners Insurance

Being proactive and prepared is essential when it comes to protecting your home against natural disasters. Here is a step-by-step guide on how homeowners can prepare for natural disasters with their insurance coverage.

Review and Update Your Policy Annually

It is crucial to review and update your homeowners insurance policy annually to ensure you have adequate coverage for potential natural disaster risks. Check if your policy includes coverage for specific disasters like floods, earthquakes, hurricanes, or wildfires.

Create a Home Inventory

Make a detailed inventory of your belongings and property to document what you own in case of damage or loss during a natural disaster. Keep this inventory in a safe place or store it digitally for easy access.

Develop an Emergency Plan

Create an emergency plan for your family that includes evacuation routes, emergency contacts, and a designated meeting place in case of a natural disaster. Practice this plan regularly to ensure everyone knows what to do in an emergency.

Contact Your Insurance Provider

Keep your insurance provider's contact information handy and know the process for filing a claim in the event of a natural disaster. Familiarize yourself with what is covered under your policy and how to expedite the claims process.

Last Recap

In conclusion, this guide has shed light on the importance of proactive planning when it comes to homeowners insurance and natural disaster risks. By understanding the key factors and steps involved, homeowners can safeguard their assets and financial well-being effectively.

Key Questions Answered

What factors should homeowners consider when planning for natural disaster risks?

Homeowners should evaluate the location, age, and condition of their home to determine the type of coverage needed for different natural disasters.

Are all types of natural disasters covered by homeowners insurance policies?

Common natural disasters covered include hurricanes, earthquakes, floods, and wildfires. Additional riders or policies may be necessary for comprehensive coverage.

How can homeowners prepare for natural disasters with their insurance coverage?

Homeowners can follow a step-by-step guide, review their coverage annually, and create a communication plan with insurance providers to expedite claims processing in the event of a natural disaster.