Exploring the world of Term Life Insurance Quotes With Flexible Policy Terms, this introduction aims to captivate readers with valuable insights and essential information.

Providing a detailed overview of the key aspects and considerations surrounding term life insurance quotes and flexible policy terms.

Overview of Term Life Insurance Quotes

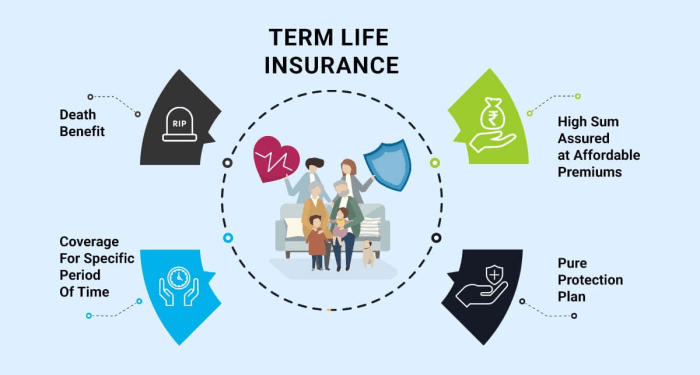

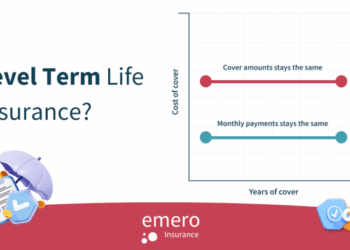

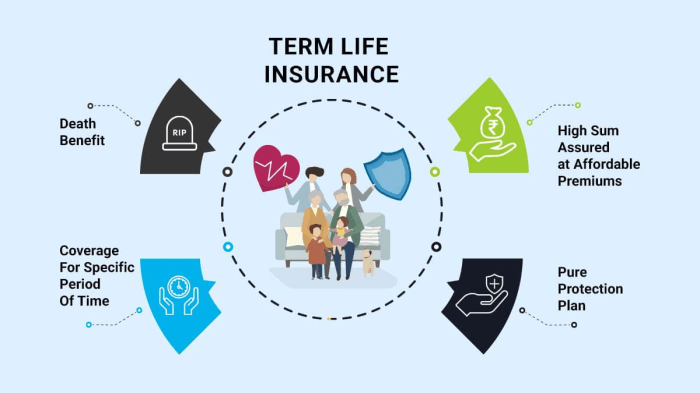

Term life insurance is a type of life insurance policy that provides coverage for a specific period, such as 10, 20, or 30 years. Unlike whole life insurance, which covers the insured's entire life, term life insurance only pays out if the insured passes away during the term of the policy.It is essential to obtain quotes from insurance providers before choosing a term life insurance policy.

This allows individuals to compare prices, coverage options, and policy terms to find the best fit for their needs and budget.Common policy terms for term life insurance include the coverage amount (death benefit), term length, premium amount, and any additional riders or provisions included in the policy.Having flexible policy terms can be beneficial for policyholders as it allows them to customize their coverage to meet their specific needs.

For example, policyholders can choose a shorter or longer term length, adjust the coverage amount, or add riders for additional protection, depending on their changing circumstances.

Factors to Consider When Comparing Quotes

When comparing term life insurance quotes, there are several key factors to keep in mind to ensure you are getting the best policy for your needs. Understanding how policy terms impact the cost of insurance premiums and the significance of flexible policy terms can help you make an informed decision.

Here are some tips on how to evaluate quotes effectively:

Policy Terms and Premium Costs

- Policy Length: The length of the term you choose will directly impact your premiums. Shorter terms tend to have lower premiums, while longer terms may cost more.

- Renewability: Check if the policy offers the option to renew at the end of the term. This can affect future premiums and overall costs.

- Convertible Options: Some policies allow you to convert your term policy to a permanent one without undergoing a medical exam. This feature can be beneficial but may also impact your initial premiums.

Significance of Flexible Policy Terms

- Customization: Flexible policy terms allow you to tailor the coverage to your specific needs, ensuring you have the right amount of protection for your circumstances.

- Adjustments: Life circumstances change, and having the flexibility to adjust your policy terms can help you stay adequately covered without overpaying for unnecessary coverage.

- Peace of Mind: Knowing that you can adapt your policy as needed provides peace of mind and financial security for you and your loved ones.

Tips for Evaluating Quotes

- Compare Apples to Apples: Ensure you are comparing similar coverage amounts, policy lengths, and features when evaluating quotes.

- Consider Your Needs: Think about your financial obligations, dependents, and long-term goals to determine the right amount of coverage for your situation.

- Review the Fine Print: Pay attention to any exclusions, limitations, or restrictions in the policy to avoid surprises down the line.

Importance of Flexible Policy Terms

When it comes to term life insurance, having flexible policy terms can make a significant difference in how well the policy aligns with your evolving needs and circumstances. Let's delve into the benefits of having flexible policy terms and how they can adapt to changing life situations.

Adaptability to Life Changes

Having flexible policy terms allows you to make adjustments to your coverage as your life circumstances change. For example, if you have a child, buy a new home, or start a business, you may need to increase your coverage to ensure your loved ones are adequately protected.

On the other hand, if your financial situation improves, you may have the option to decrease your coverage or adjust the length of the term.

- Flexible policy terms can accommodate major life events, such as marriage, divorce, or the birth of a child.

- They allow you to tailor your coverage to meet your specific needs at different stages of life.

- Adjusting your policy as needed can help you save on premiums and ensure you have the right amount of coverage at all times.

Advantages Over Rigid Policy Structures

In contrast, rigid policy structures may lock you into a set coverage amount and term length, leaving you with limited options to make changes when needed. With flexible policy terms, you have the freedom to adapt your coverage to suit your current situation without having to purchase a new policy altogether.

- Flexibility provides peace of mind knowing that your insurance can evolve with your changing needs.

- Rigid policies may not offer the same level of customization and may not be as cost-effective in the long run.

- Being able to adjust your coverage ensures that you are adequately protected without overpaying for unnecessary features.

Customizing Policy Terms to Suit Your Needs

When it comes to term life insurance, customizing your policy terms can greatly impact the coverage you receive and how it aligns with your financial goals. Here's how policyholders can tailor their policy terms to suit their individual needs.

Selecting the Right Term Length

- Consider your current financial obligations and how long you need coverage for.

- Shorter terms may be suitable for specific needs like paying off a mortgage, while longer terms provide more extensive coverage.

- Consult with a financial advisor to determine the ideal term length based on your unique circumstances.

Add-On Options for Enhanced Flexibility

- Riders such as accelerated death benefits, disability income, or critical illness coverage can be added to your policy for additional protection.

- These add-ons can enhance your policy's flexibility and provide extra benefits in case of unexpected events.

- Review all available options with your insurance provider to customize your policy according to your specific needs.

Tailoring Policy Terms to Align with Financial Goals

- Adjust the coverage amount to ensure it meets your financial obligations, such as debts, education expenses, or income replacement for your family.

- Consider your long-term financial goals and how your policy can support them, whether it's retirement planning or leaving a legacy for your loved ones.

- Regularly review and update your policy terms as your financial situation changes to ensure continued alignment with your goals.

Last Word

In conclusion, Term Life Insurance Quotes With Flexible Policy Terms offer a crucial financial safeguard with customizable options to suit individual needs. This guide has shed light on the importance of flexibility in policy terms and the impact it can have on policyholders' lives.

FAQ

What is the difference between term life insurance and other types of insurance?

Term life insurance provides coverage for a specific period, while other types like whole life insurance offer coverage for the entire life of the insured.

How can policyholders customize their term life insurance policy terms?

Policyholders can customize their policy terms by choosing the term length, adding optional riders, and adjusting coverage amounts to meet their specific needs.

Why is obtaining quotes before choosing a policy important?

Obtaining quotes allows individuals to compare costs, coverage options, and policy terms from different insurance providers to find the most suitable policy for their needs.