Comparing Home and Auto Insurance Bundles: Are They Worth It?

Delving into the realm of Comparing Home and Auto Insurance Bundles: Are They Worth It?, readers are invited to explore a world where the amalgamation of home and auto insurance sparks curiosity and practicality. This introduction sets the stage for an enlightening journey through the intricacies of bundled insurance policies.

Overview of Home and Auto Insurance Bundles

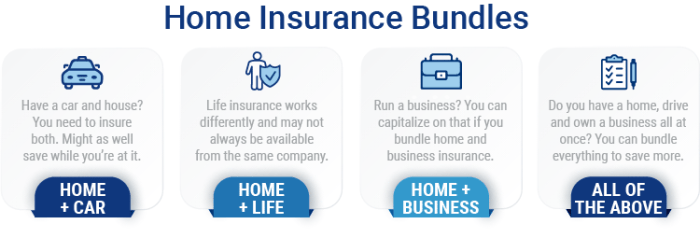

Home and auto insurance bundles refer to the combination of both home insurance and auto insurance policies from the same insurance provider. By bundling these two types of insurance together, policyholders can enjoy various benefits and potentially save money on their insurance premiums.

Benefits of Bundling Home and Auto Insurance

When you bundle home and auto insurance together, you can often receive discounts from the insurance provider. These discounts are a way for insurance companies to incentivize customers to purchase multiple policies from them, ultimately saving the policyholder money in the long run.

- Bundling home and auto insurance can lead to convenience by having both policies managed by the same insurance provider. This can streamline communication and claims processes, making it easier for policyholders to manage their insurance needs.

- Policyholders may also benefit from a simplified billing process when bundling home and auto insurance. Instead of managing separate payments for each policy, bundling allows for a single combined premium, making it easier to keep track of and pay for insurance coverage.

Potential Savings with Bundling

One of the primary reasons why individuals consider bundling home and auto insurance is the potential cost savings. Insurance companies often offer discounts on premiums when policies are bundled together, resulting in lower overall insurance costs for policyholders.

By bundling home and auto insurance, policyholders can save anywhere from 5% to 25% on their total insurance premiums, depending on the insurance provider and the specific policies being bundled.

Coverage Options and Limitations

When it comes to bundled home and auto insurance, there are various coverage options that are commonly included in these policies. However, it is important to be aware of any limitations or exclusions that may apply to bundled policies. Let's take a closer look at the coverage options and limitations of these bundled insurance policies.

Common Coverage Options Included in Bundled Home and Auto Insurance

- Property Damage Coverage: This coverage protects your home and belongings in case of damage from covered perils, such as fire, theft, or vandalism.

- Liability Coverage: This provides protection in case you are found liable for injuries or damages to others, both at home and while driving your car.

- Personal Property Coverage: This covers your personal belongings, such as furniture, electronics, and clothing, in case they are damaged or stolen.

- Medical Payments Coverage: This helps cover medical expenses for you and your passengers in case of an accident, whether at home or on the road.

- Loss of Use Coverage: If your home becomes uninhabitable due to a covered loss, this coverage helps pay for additional living expenses while repairs are being made.

Limitations and Exclusions in Bundled Policies

- Policy Limits: Bundled policies may have limits on the amount of coverage provided for certain items, so it's important to review these limits carefully.

- Excluded Perils: Some perils, such as floods or earthquakes, may be excluded from bundled policies and require separate coverage.

- Coverage Gaps: While bundling can save you money, it's essential to ensure there are no gaps in coverage between your home and auto insurance.

Comparison of Coverage Options

When comparing standalone and bundled insurance policies, it's crucial to consider the specific coverage options included in each. Standalone policies may offer more customization and flexibility in choosing coverage limits and deductibles, while bundled policies can provide convenience and potential cost savings.

Ultimately, the decision between standalone and bundled insurance will depend on your individual insurance needs and preferences.

Cost Analysis

When it comes to deciding between separate home and auto insurance policies versus bundled insurance, cost plays a significant role. Let's dive into the breakdown of costs and factors that influence the overall expenses.

Breakdown of Costs

When you opt for separate home and auto insurance policies, you are essentially paying individual premiums for each type of coverage. This means you have two separate bills to manage, which can sometimes lead to higher overall costs compared to a bundled insurance policy.

Bundled insurance typically offers a discount for combining both policies under one provider, resulting in potential savings for policyholders.

Factors Influencing Cost of Bundled Insurance

Several factors can influence the cost of bundled insurance. One key factor is the insurance provider itself, as different companies offer varying rates and discounts for bundled policies. Your location, coverage limits, deductibles, and the type of home and vehicle you own can also impact the cost of bundled insurance.

Additionally, your driving record, credit score, and claims history may play a role in determining the final premium for a bundled policy.

Comparison of Premium Rates and Savings

Premium rates for bundled insurance are often lower than the combined cost of separate home and auto insurance policies. Insurance companies typically offer discounts for bundling policies, which can result in significant savings for policyholders. By consolidating your insurance needs with one provider, you may be eligible for multi-policy discounts, loyalty rewards, or other incentives that can lower your overall insurance costs.

Customer Experience and Satisfaction

When it comes to bundled home and auto insurance, customer experience and satisfaction play a crucial role in determining the value of such packages. Let's delve into how customers feel about managing claims, overall satisfaction, and their experiences with bundled insurance compared to standalone policies.

Customer Reviews and Experiences

Customer reviews and experiences with bundled home and auto insurance policies often highlight the convenience of having both coverages under one roof. Many customers appreciate the ease of managing their policies and making claims seamlessly. The streamlined process of dealing with a single insurance provider for multiple policies can save time and eliminate potential confusion.

Ease of Managing and Making Claims

Managing and making claims with a bundled policy is generally perceived as more convenient by customers. With a single point of contact for both home and auto insurance needs, policyholders find it easier to navigate through the process and resolve any issues efficiently.

The convenience of having all insurance-related matters handled by one provider simplifies the overall experience for customers.

Customer Satisfaction Levels

Customer satisfaction levels with bundled insurance policies tend to be higher compared to standalone policies. The comprehensive coverage, potential cost savings, and convenience factor contribute to increased satisfaction among policyholders. Knowing that both their home and auto insurance needs are taken care of by a single provider gives customers peace of mind and a sense of security.

Customization and Flexibility

When it comes to home and auto insurance bundles, one of the key factors that individuals consider is the level of customization and flexibility offered. Let's delve into how these bundled policies can be tailored to suit individual needs and compare them to standalone insurance options.

Customization Options

- With bundled insurance policies, customers often have the flexibility to customize their coverage levels for both home and auto insurance. This means they can adjust the limits and deductibles to align with their specific needs and budget.

- Some insurance providers also offer add-on options for bundled policies, such as roadside assistance, identity theft protection, or enhanced coverage for high-value items in the home.

Comparison with Standalone Insurance

- Standalone insurance policies typically offer a higher degree of customization compared to bundled policies. Customers can tailor each policy separately to meet their exact requirements without being restricted by a bundled package.

- However, bundling home and auto insurance can still provide a convenient way to manage policies and potentially save on overall costs, even if there are some limitations in customization.

Limitations in Customization

- One limitation of bundled insurance policies is that customers may not have the same level of control over specific details compared to standalone policies. For example, they may have to accept a standard set of coverage options for both home and auto insurance, which may not fully meet their unique needs.

- Additionally, certain customization options available for standalone policies, such as specialized coverage for rare or valuable items, may not be as easily accessible in a bundled package.

Wrap-Up

In conclusion, the comparison of home and auto insurance bundles unveils a nuanced landscape of savings, coverage, and customer satisfaction. As the discussion draws to a close, readers are left with a comprehensive understanding of the value and considerations surrounding bundled insurance policies.

Question Bank

Are there any limitations to customization with bundled insurance policies?

While bundled insurance policies offer flexibility, there may be limitations in customizing specific aspects compared to standalone policies. It's essential to review the terms and conditions to understand the extent of customization available.

How do customer satisfaction levels differ between bundled and standalone insurance policies?

Customer satisfaction levels with bundled insurance policies tend to be higher due to the convenience of managing multiple coverages under a single policy. This streamlined approach often leads to greater overall satisfaction among policyholders.

What factors influence the cost of bundled insurance?

The cost of bundled insurance can be influenced by various factors such as the type and extent of coverage, the insurance provider, the policyholder's location, driving record, and credit score. These factors play a significant role in determining the overall cost of bundled insurance.